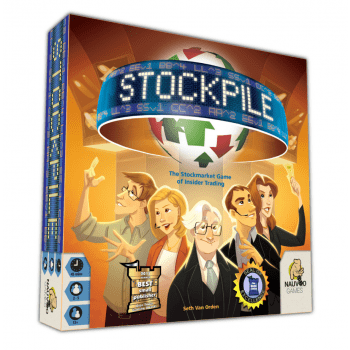

Stockpile: The Stockmarket Game of Insider Trading

|

Брой играчи: 2 - 5 Времетраене: 45 мин Възраст: 13+ |

|

Stockpile is an economic board game that combines the traditional stockholding strategy of buy low, sell high with several additional mechanisms to create a fast-paced, engaging and interactive experience.

In Stockpile, players act as stock market investors at the end of the 20th century hoping to strike it rich, and the investor with the most money at the end of the game is the winner. Stockpile centers on the idea that nobody knows everything about the stock market, but everyone does know something. In the game, this philosophy manifests in two ways: insider information and the stockpile.

First, players are given insider information each round. This information dictates how a stock’s value will change at the end of the round. By privately learning if a stock is going to move up or down, each player has a chance to act ahead of the market by buying or selling at the right time.

Second, players purchase their stocks by bidding on piles of cards called stockpiles. These stockpiles will contain a mixture of face-up and face-down cards placed by other players in the game. In this way, nobody will know all of the cards in the stockpiles. Not all cards are good either. Trading fees can poison the piles by making players pay more than they bid. By putting stocks and other cards up for auction, Stockpile catalyzes player interaction, especially when potential profits from insider information are on the line.

Both of these mechanisms are combined with some stock market elements to make players consider multiple factors when selling a stock. Do you hold onto a stock in hopes of catching a lucrative stock split or do you sell now to avoid the potential company bankruptcy? Can you hold onto your stock until the end of the game to become the majority shareholder, or do you need the liquidity of cash now for future bidding? Do you risk it all by investing heavily into one company, or do you mitigate your risk by diversifying your portfolio?

In the end, everyone knows something about the stock market, so it all comes down to strategy execution. Will you be able to navigate the movements of the stock market with certainty? Or will your investments go under from poor predictions?